Why is Hochul seeking to UNDERFUND our pensions in her latest executive bill? Are we seeing a sequel similar to Medicare Advantage?

Where is UFT leadership on this significant issue? Have local unions made a deal to mortgage retiree benefits once again ?

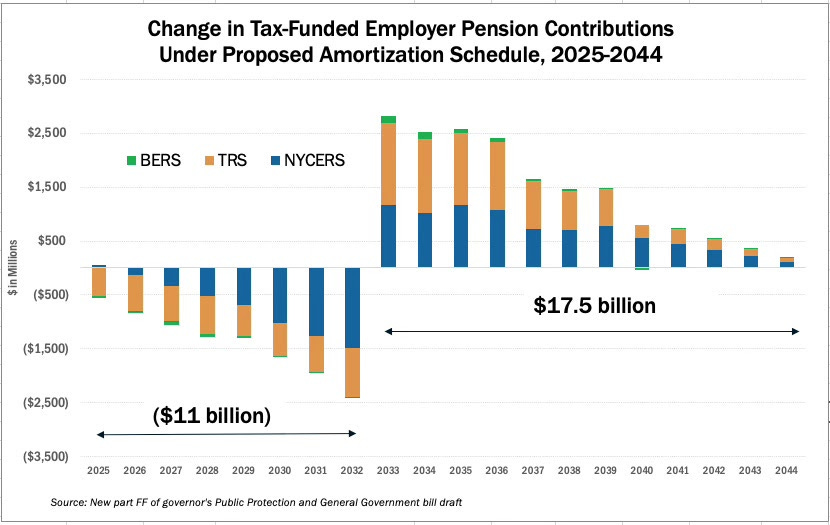

Governor Hochul’s executive bill to defer $11 billion in NYC pension payments—only to owe $18 billion by 2044—is a reckless gamble that puts UFT members’ retirement security at risk. This move shifts today’s financial burden onto future educators and retirees, creating massive uncertainty about whether pension obligations will be fully met in the years to come.

By underfunding the pension system now, the city and state are essentially borrowing against our futures, potentially forcing increased employee contributions, reduced benefits, or higher costs down the line. Rather than responsibly managing pension obligations, NYC is using this as a budget trick to avoid making tough financial decisions today.

This is a dangerous precedent—if they can defer payments now, what stops them from doing it again?

As candidate for Treasurer for A Better Contract - UFT Members, I will fight to ensure pension funds remain fully funded and protected from these political games, demand full transparency in UFT’s financial oversight, and work with other unions to push back against this reckless policy before it causes irreparable harm to our retirement security.

This will impact all active and retired UFT members.

Tier 6 members are already struggling under an underfunded, inequitable system—one that forces them to contribute up to 6% of their salaries while waiting until age 63 to retire with a smaller pension than their Tier 4 counterparts. Now, by kicking this financial burden down the road, the city is making their retirement even less secure. If NYC owes $18 billion by 2044, how can Tier 6 members trust that their pensions will be safe when they need them most?

It's very strange that the UFT isn’t actively lobbying against this pension deferral plan, especially given its long-term financial risks for members, particularly Tier 6 educators. The union is supposed to be the first line of defense against policies that could weaken pension security, yet there’s no public indication that it's taking a strong stand on this issue.

Please educate yourself on this budget bill and reach out to your respective members in government.

Find the executive budget proposal here:

https://drive.google.com/file/d/1Sae6zZ80H5oosdJJsPi-3m0t-sSY03BS/view

Here is the city’s rationale for this “smoothing” decision:

https://drive.google.com/file/d/1TUxHBRA0cAlmo_7Hy1sj2uYq7Iqsa1aC/view?usp=drivesdk

This proposal was initially shared at the NYC TRS trustees meeting in November of 2024. You can view the meeting here:

Some important takeaways and questions we all need to be asking:

The UFT leadership seems to be making the same mistake it did with retiree healthcare. They are not giving members any information about something that could have a dramatic impact. Nor are we allowed to have input in our policy making regarding this issue.

It seems they haven’t learned their lesson from the losses they took in the retiree chapter election.

The State budget is due in less than a month and this is supposedly part of it, so where does the UFT stand?

Are the pension trustees in favor of this? If so, why?

Why did our UFT pension trustees, Tom Brown and Victoria Lee, have no questions for the actuary at the November TRS meeting when this was presented?

Does the UFT leadeship support this?

Is Mulgrew going to talk about this at all at a town hall or the delegate assembly?

What are the pros and cons of doing this?

How can anyone make a decision on whether or not to support this if no one knows anything about it?

What happens if the stock market or the city’s revenues go down during the years when the higher payments are supposed to happen?

This affects 3 of the 5 pension plans in the city. What do the other pension funds think about this?

If this goes through, what will the money saved go to? Is this a deal for salary increases?

What do the reps in Albany know and think about this?

We will be discussing this pressing issue and other issues important to retirees at our Retiree Meet and Greet meeting on Tuesday, March 11 at

7 PM. Join us.